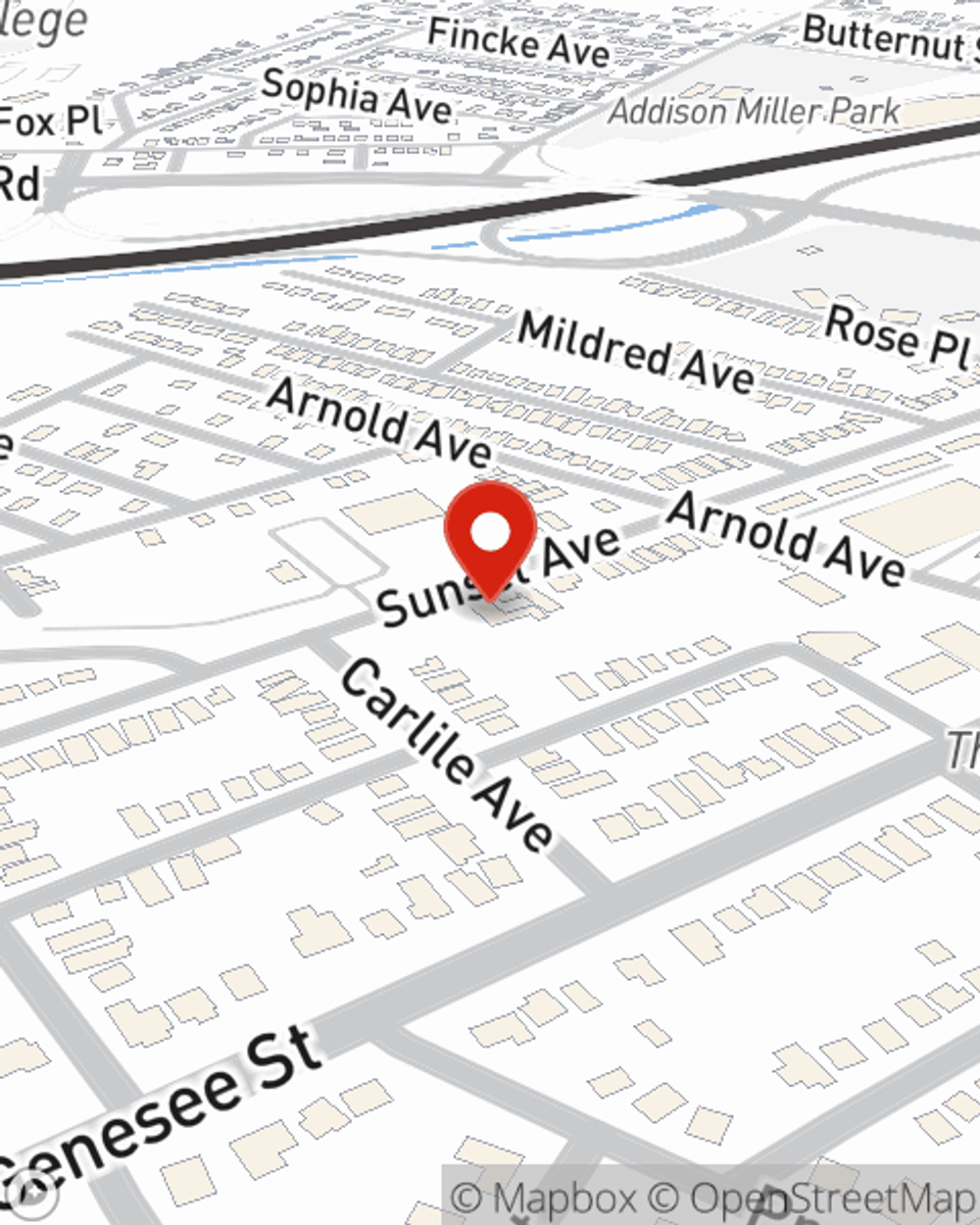

Business Insurance in and around Utica

Looking for insurance for your business? Search no further than State Farm agent Dan Meehan!

This small business insurance is not risky

Insure The Business You've Built.

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent Dan Meehan, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Looking for insurance for your business? Search no further than State Farm agent Dan Meehan!

This small business insurance is not risky

Strictly Business With State Farm

If you're looking for a business policy that can help cover computers, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Contact State Farm agent Dan Meehan today to explore how one of the leading providers of small business insurance can safeguard your future here in Utica, NY.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Dan Meehan

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.